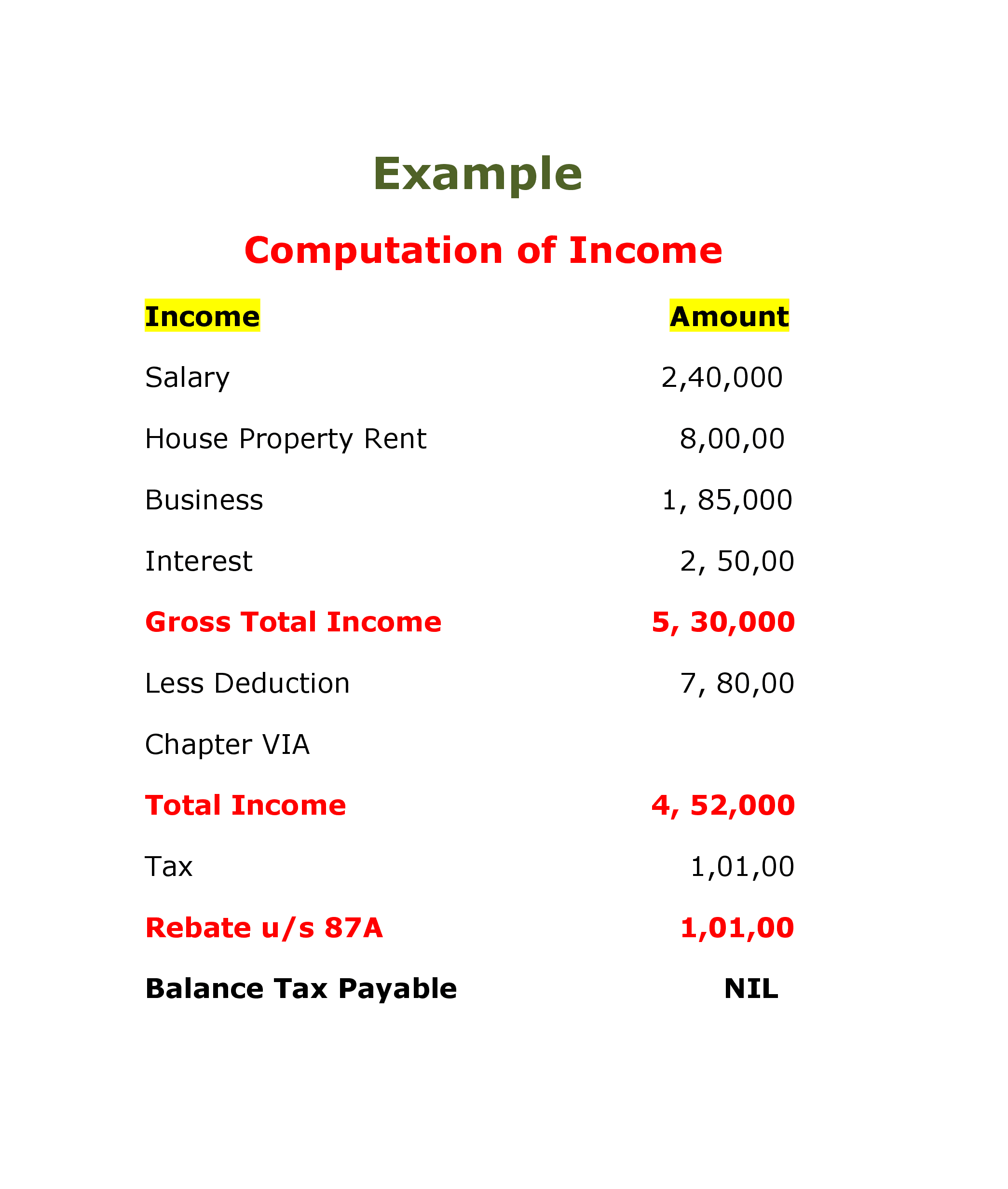

Tax Rebate U/S 87a For Ay 2024-25 In India. No tax rebate is being given if you have sold mutual fund or shares and earned short term capital gains. — section 87a provides a tax rebate to reduce the net tax payable to nil for eligible taxpayers.

5.00 lacs for the old tax regime and within rs.7.00 lacs for the new tax regime. — section 87a of the income tax act provides a rebate for resident individuals whose total income does not exceed a specified threshold.

Tax Rebate U/S 87a For Ay 2024-25 In India Images References :

Source: sarahbnicoline.pages.dev

Source: sarahbnicoline.pages.dev

Rebate U/S 87a For Ay 202425 Old Tax Regime Dehlia Phyllys, 12,500 for the old tax regime and rs.

Source: taxxguru.in

Source: taxxguru.in

tax rebate U/s 87A for the Financial Year 202223, — section 87a of the income tax act provides a rebate for resident individuals whose total income does not exceed a specified threshold.

Source: arthikdisha.com

Source: arthikdisha.com

Tax Rebate U/S 87A for AY 202425 & FY 202324, To make the new tax regime more attractive, the rebate under section 87a has been hiked to rs 25,000 for taxable income up to rs 7 lakh.

Source: www.wintwealth.com

Source: www.wintwealth.com

Tax Rebate Under Section 87A, — section 87a provides a tax rebate to reduce the net tax payable to nil for eligible taxpayers.

Source: www.youtube.com

Source: www.youtube.com

Rebate Under 87a of Tax Section 87a of Tax Act 87a, In india, the rebate limit for section 87a is rs.

Source: kirikikelia.pages.dev

Source: kirikikelia.pages.dev

Rebate U/S 87a For Ay 202425 Old Tax Regime Ynez Analise, It allows you to claim the refund if your yearly income does not exceed.

Source: www.youtube.com

Source: www.youtube.com

Section 87A rebate in old & new tax regime 2425 87A Rebate New, — according to your article, tax rabate under section 87 a is available to individual, huf, association of person (aop), boi & artificial jurisdictional person who.

Source: devinablaverne.pages.dev

Source: devinablaverne.pages.dev

Tax Rebate U/S 87a For Ay 202425 Timmi Steffane, No tax rebate is being given if you have sold mutual fund or shares and earned short term capital gains.

Source: nancyqmathilda.pages.dev

Source: nancyqmathilda.pages.dev

Section 87a Of Tax Act Ay 202425 Elsie Idaline, Under this regime, if you are a resident.

Source: devinablaverne.pages.dev

Source: devinablaverne.pages.dev

Tax Rebate U/S 87a For Ay 202425 Timmi Steffane, — currently, section 87a allows individuals to claim a tax rebate of rs 12,500 under the old tax regime and rs 25,000 under the new tax regime.